Iowa First Time Homebuyer Tax Credit

Homeownership is something many families strive for, but it is difficult to save for a down payment on a first home. All loans subject to a minimum 640 credit score.

First-time Homebuyer Programs In Iowa - Newhomesource

Remember, the rate will change as your.

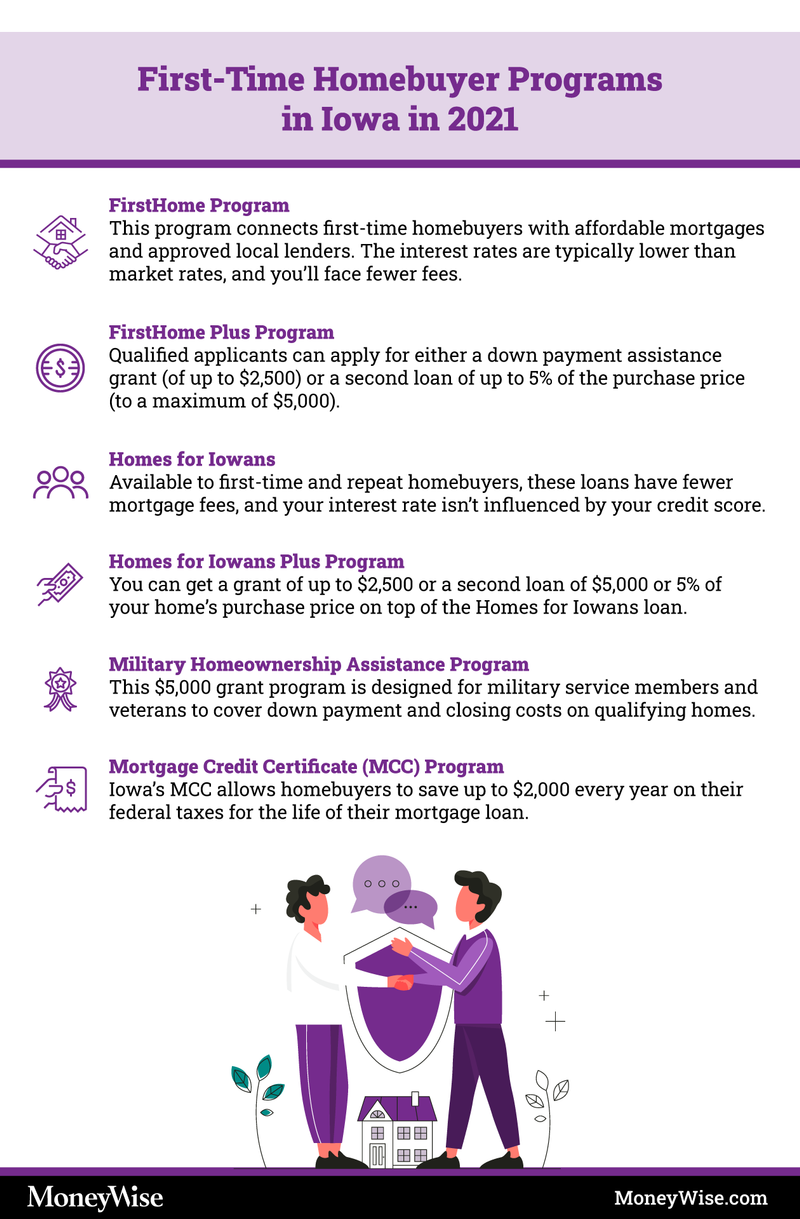

Iowa first time homebuyer tax credit. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. The short answer is, unfortunately, no. Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan.

Every year, you’re granted a direct credit on your federal taxes of 50% of the annual interest you pay on your mortgage. That means, in your first year, you’ll pay $8,250 in interest on your mortgage. Borrowers repay the government a portion of their gain on the sale of their home, depending on (1) whether there is a gain on the sale, (2) the household income at the time of sale, and (3) if the sale occurs within nine years of buying the home.

Borrowers who buy their homes using the firsthome or firsthome plus homebuyer programs may be subject to recapture tax. For more information visit the iowa finance authority’s website. The firsthome and homes for iowans programs may provide eligible iowans with an affordable mortgage and down payment and closing cost assistance.

(1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which the eligible home costs are paid or. In a nutshell, it reduces your federal income taxes, creating additional income for you. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative.

The home must be occupied by the buyer as a primary residence within 60 days of closing. Stay informed, subscribe to receive updates. With that loan amount and interest rate, you’d receive a 21.8% rate for the mcc program, meaning you’d receive a tax credit of $1,640.

Iowa residents will be able to take advantage of the new tax credit on deposits made after jan.

First-time Homebuyer Programs In Iowa - Newhomesource

First-time Homebuyer Programs In Iowa - Newhomesource

Iowa First Time Home Buyer Programs

South Dakota First-time Homebuyer Assistance Programs Bankrate

Home Ownership Matters New Option In Iowa To Save For A Down Payment For A Home

First-time Homebuyer Programs In Iowa - Newhomesource

/cloudfront-us-east-1.images.arcpublishing.com/gray/KTWHUCEPO5M35BN7EVF4E4XJLE.jpg)

Iowa First-time Homebuyers Get Tax Break

Iowa First Time Home Buyer Programs

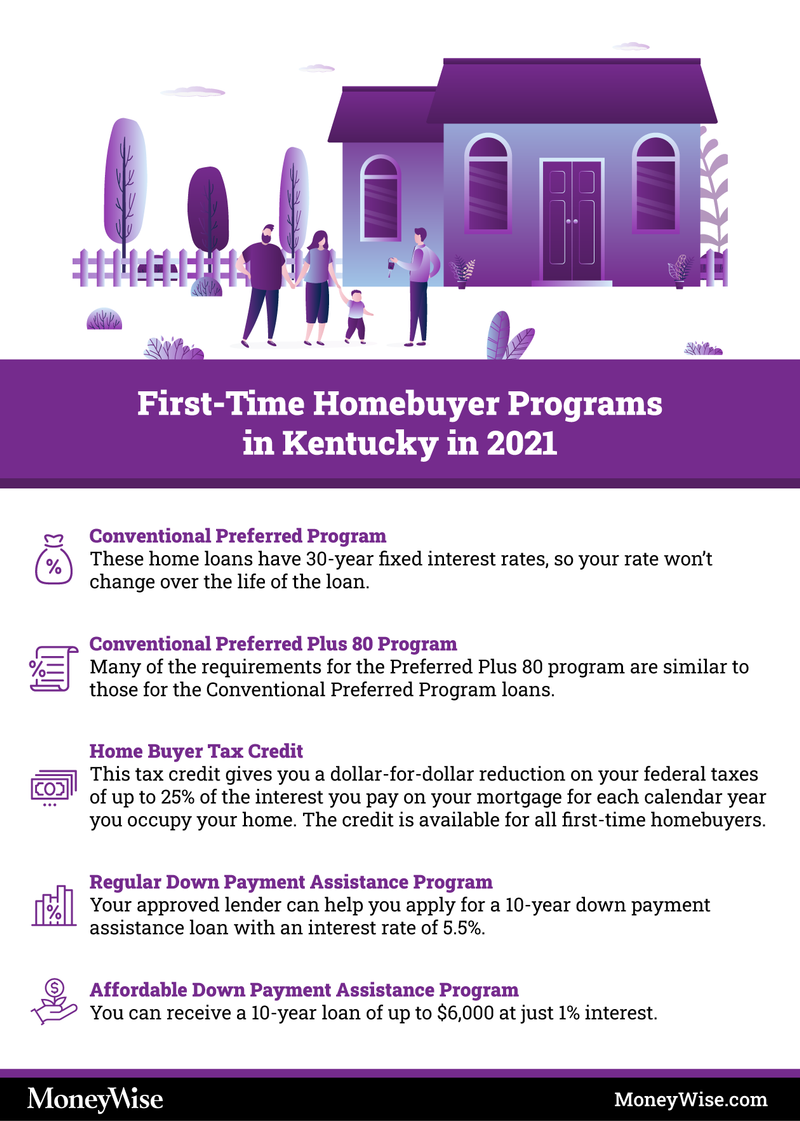

First-time Homebuyer Programs In Kentucky 2021

First-time Homebuyer Programs In Iowa 2021

First-time Homebuyer Programs In Iowa 2021

South Dakota First-time Homebuyer Assistance Programs Bankrate

Iowa First-time Home Buyer Programs Rmn

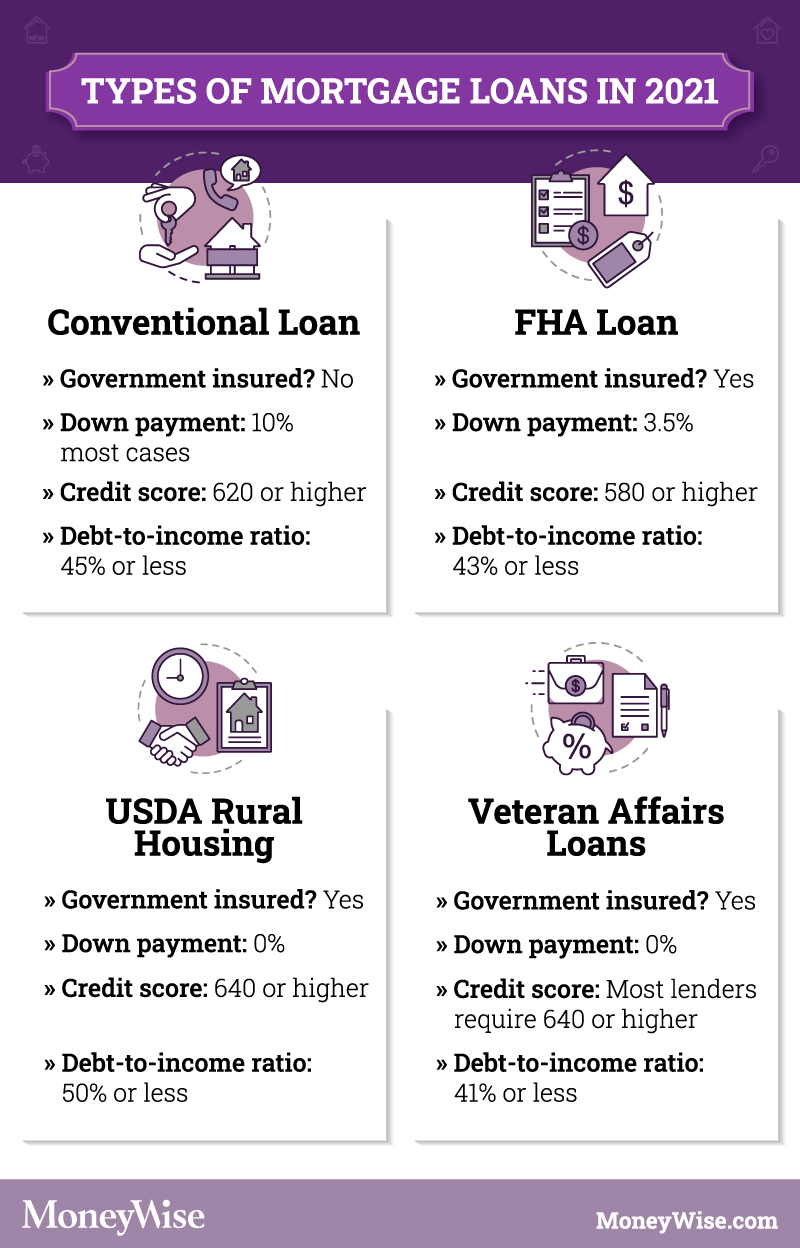

First-time Home Buyer Programs In 2021

First Time Homebuyer Grants And Programs Nextadvisor With Time

First-time Homebuyer Programs In Ohio 2021

Iowa Ia First-time Home Buyer Programs For 2019 - Smartasset

Iowa Ia First-time Home Buyer Programs For 2019 - Smartasset

How A First Time Homebuyers Saving Account Can Help You Buy Your First Home

Komentar

Posting Komentar